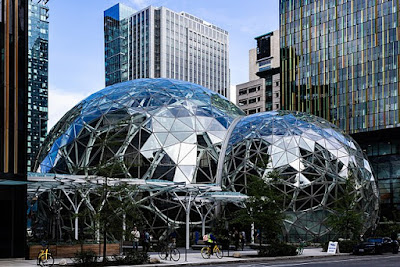

Although I have an MBA, my learnings about investing come from Charlie Munger and Warren Buffett, Vice-Chairman and Chairman of Berkshire Hathaway Inc. I have attended Berkshire Hathaway shareholder meetings about dozen times and the four basic rules of investing that I have learned are: Do you understand the business you are buying (think of buying stock of a business like buying the entire business)? Can you predict the earnings of the business for the next five to ten years? Does the business have a competitive advantage (i.e. does the business have something that a competitor would find hard to copy)? Is the stock fairly priced? Amazon headquarters in Seattle, WA. Photo Credit: Wikipedia These four rules are easy to understand and hard to implement. A few years ago, when Amazon stock was trading below $300 and its P/E (Price to Earnings ratio), which is one way to determine if the stock is fairly priced, was above 2,000. ...